Table of contents

No headings in the article.

Prices are tanking. Basically, every crypto is down 50% or more. And the biggest question in my mind is; well, you've guessed right "Is This The End?", The turuth is no one knows but to have an insight at least. Let's look at what some of the most outspoken people in the industry are saying in order to determine if we're in the great crypto recession or if this is some kind of temporary blip. First, let's gather the context. How did we get here? I'll attempt to do it in 37 seconds. Timer, please. Thank you.

When have we seen a huge surge of investments pop up in a short period where it seemed like there was unlimited money and what mattered most was marketing above all else? You guessed it, Beanie Babies. These suckers retail for, like, $2.50, but could sell for as much as $5,000 on eBay. Sorry, I'm not actually comparing crypto to Beanie Babies, but I am comparing crypto to the.com bubble. And before you think like, yeah, I've heard bubbles before, just check this out. Back in, when the world was completely different. There were no social media and no one was getting swatted on Twitch. The Internet was an infant only really accessed by nerds, nerds that became billionaires. But then 1995 came and a company named Netscape made a far better browser than anything currently available. They went public and the stock doubled on the first day of trading. Tons of other companies threw down their Beanie Babies and jumped into the dotcom market without having any supporters. Every investor was looking itching the next Netscape, but most didn't invest for the sake of technology. The goal was to simply get rich quickly and get out of here.

And it was working. You literally couldn't lose money for a while because of this. The companies who had the most publicity ended up with the most investors, not the companies with solid business models and well-thought revenue streams. This led to bigger and bigger ideas and insane amounts of advertising. 17 dot.com companies had ads in the Super Bowl in 2000, and it was all fine and dandy until Japan fell into a recession. Markets started getting tighter. Investors got spooked. They took their money out of riskier investments, and companies were then left relying on revenue to keep the door open, not investor money. Are you kidding me? We didn't sign up for this. We signed up for flashy growth, not solid income streams. So when the bad times started, you saw the largest and riskiest bets crumbled first. Then moving on to 2001. The US entered a recession and Cynara tech companies. Now they don't all disappear. Many of them, like Amazon, take a hit, survive, and then go on just to become behemoths. But that wasn't without losing more than 90% in stock price first. Now, I have to say that many of the ideas that exploded in the.com bubble in a bad way ended up turning into successes years later.

Not the companies, the ideas. Pets.com failed where Chewy succeeded, cosmo failed, where Instacart figured out grocery delivery. And this really stuck with me because good ideas failed in the.com bubble. It's a good reminder that an idea is not enough by itself for a business to be successful. In the case of the.com bubble, the tech just simply wasn't there yet. Many of these companies lack the organization to get their big ideas done. Fast forward to the day and it's eerily close to the crypto market

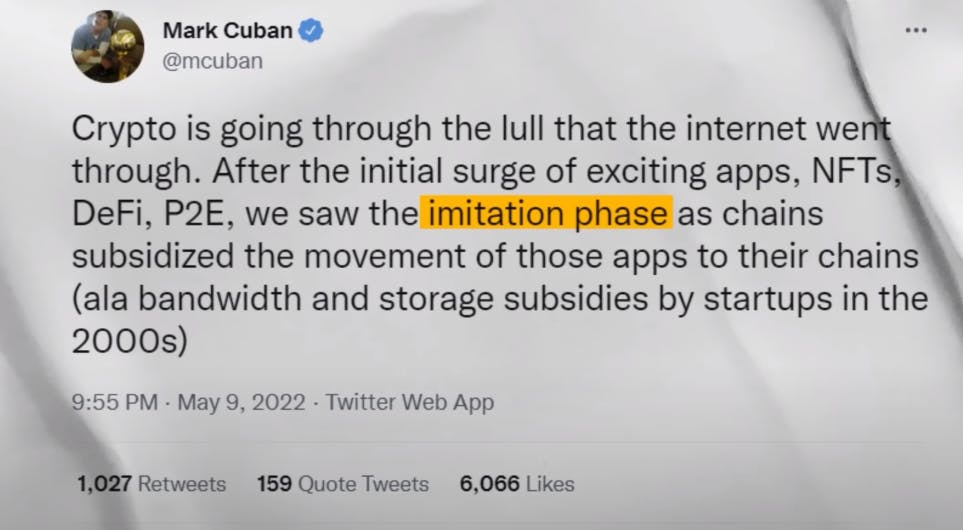

Now, one of the biggest winners of the.com era was Mark Cuban. He's also a big investor in crypto. He sees strong similarities between today and the early 2000s. Back in 1999, he sold his Internet radio company Broadcast.com to Yahoo for a whopping $5.7 billion. After that, he went on to other lucrative deals, became the owner of the Dallas Mavericks, and now tells people their presentations suck on Shark Tank. He says that crypto is in an imitation phase and this is really interesting. He says the tech is there, but it's not yet perfect.

And this is a point worth thinking about. Do you have an idea for a smart contract that could actually solve a problem? If so, now is the time to build it. Now is the time to do it now. Enough about Cuban. What is costar Kevin Lee saying about the current crypto market? O'Leary is a successful investor who sold his original business, The Learning Company, to Mattel for over $3 billion. Again, during the.com era, it was a crazy time. Now, aside from being an investor, he's involved himself in bitcoin and Ethereum. This is what he recently said about NFTs.

NFT's Have corrected the Las Vegas side of crypto, it has had a nightmarish correction and I think that's very good in the sense that it helps separate the wheat from the chaff. The traditional projects have remained relatively stable. Sure, they've had a correction, but that's the volatility that will be inherent in crypto until there's policy.

Leery thinks there are a lot of copycat projects that hold no real value and this crash is going to take them out back and shoot them, leaving only the best projects to survive. But what about the future of crypto?

We don't know which one of these projects is going to win, but the whole premise is that you want these for financial services. And I still believe that in ten years crypto will be the 12th sector of the economy, but all the existing tokens will not exist.

So in Kevin's eyes, good cryptos are here to stay. And Cuban seems to agree. But not everyone feels that way and it's a little bit worrisome. Peter Schiff is one of those people. He has one of the bleakest opinions as to what's happening in the economy right now. And on this, I have two major thoughts. First, the man did call the 2008 recession way before it even began, like two years before. So we have to give credit where credit is due. But second, Schiff, who runs a gold fund, makes the most money when gold is doing well, and gold does the best when the economy is in a bad place. So there is a bit of an incentive for him to kind of want a recession, which is something worth keeping in your mind either way. Schiff has never really been a fan of the crypto space. Here's a recent tweet from him. He says, given the fact that prices of everything are increasing, this means people will be forced to sell their bitcoin to cover regular living expenses.

In another tweet, shift says bitcoin is headed to $20,000 and Ethereum $1000 and that this is not a dip you should buy. I will say in the days after that tweet, both bitcoin and Ethereum did fall in price quite dramatically.

Right now we're seeing some value plays in stocks, but nothing yet that's like a, oh, my God, I can't believe how cheap that stock is. Once we start seeing that, people will slowly begin buying back. Then we'll have a big stock or two pop off, going up like 20% in a week, and the market will begin to slowly recover, helping to instill confidence back into the crypto space and money will start to flow back into that space as well. But the big issue is we really don't know when that will happen. Is it two months? six months? A year? I wish I knew. Only, here is what I think there's going to be a large bankruptcy event that happens in the stock market. If this pressure continues, a company will pop, probably a big one, and that will cause even more panic in the short run, creating some awesome deals. But in the slightly longer run, it will act as this kind of relief valve for the economy. Almost seems like we have to occasionally offer up the economy, a sacrifice for things to get better.